Compounded daily formula

Formula For daily compound interest. So the formula for an ending investment is.

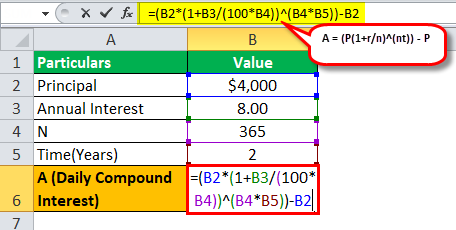

How To Calculate Daily Compound Interest In Excel Statology

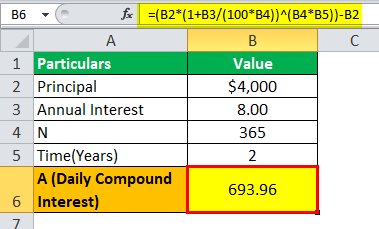

And the amount is borrowed for two years.

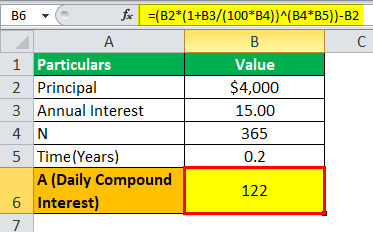

. Now he has recently learned about the effect of compounding on the final amount at the time of maturity and seeks to calculate. Compounded Amount Compounding Formula Example 2. Here we discuss how to calculate daily compound interest using its formula along with examples.

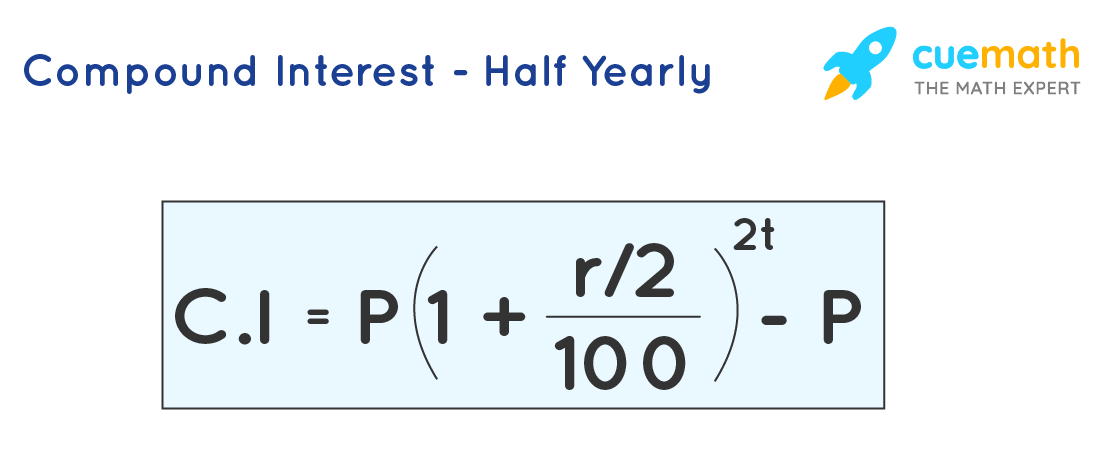

The interest is calculated on the principal amount and the interest accumulated over the given periods. The time value of money TVM is the idea that money available at the present time is worth more than the same amount in the future due to its potential earning capacity. For interest compounded annually the amount is found through.

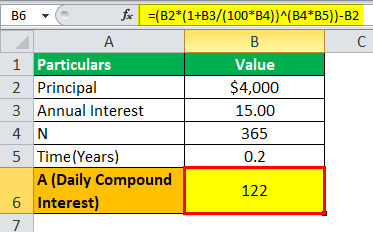

B11B2B3B4B3 and click enter. D is the number of days for which interest is being calculated. Compound interest or compounding interest is interest calculated on the initial principal and also on the accumulated interest of previous periods of a deposit or loan.

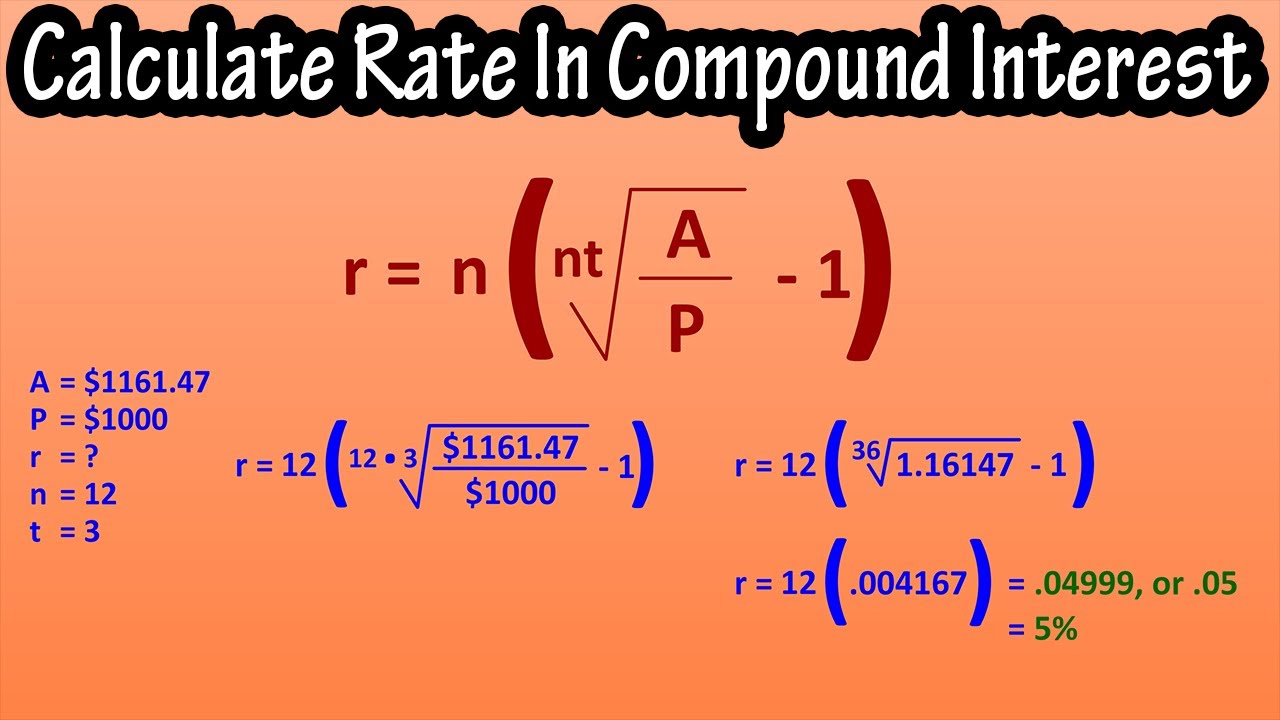

Rule Of 72. The formula for capital investment can be derived by using the following steps. Time Value of Money - TVM.

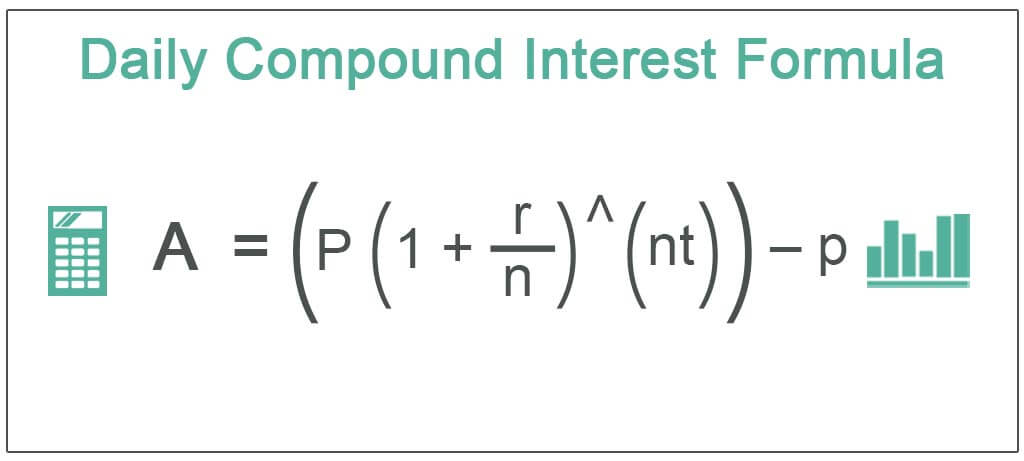

The daily compound interest formula is expressed as. Ie n 365. The financial institution where you are depositing the money is offering you a 10 interest rate which will be compounded daily.

Lets start with the good news. For daily compounding the value for n number of compound periods per year is typically 365 and you use total number of days in place of nt like this. P1r12 n 1r360d -P.

Compounded daily the total principal and interest earned balance is 298352 after 5 years. Following is the formula for calculating compound interest when time period is specified in years and interest rate in per annum. Formula for Daily Compounding.

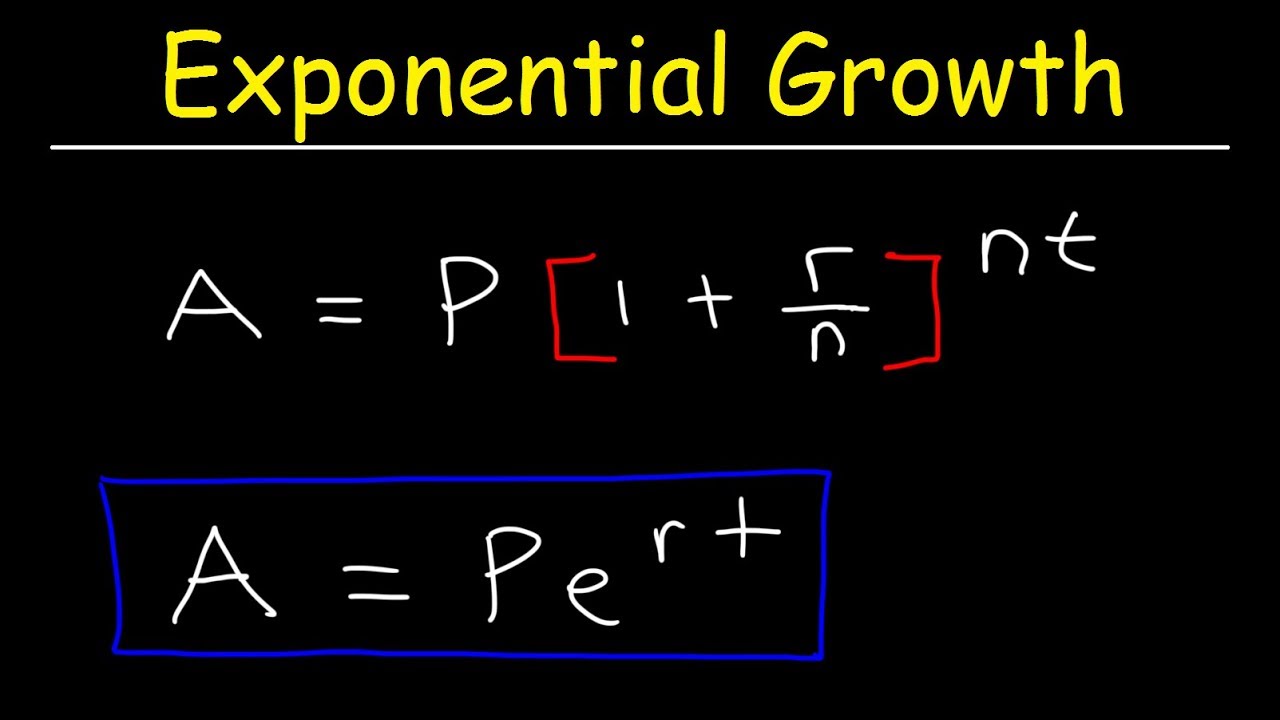

P is the amount of principal or invoice amount. It is an extreme case of compounding since most interest is compounded on a monthly quarterly or semiannual. Continuously compounded return is what happens when the interest earned on an investment is calculated and reinvested back into the account for an infinite number of periods.

Generally the investment interest rate is quoted per annum basis. Guide to Daily Compound Interest Formula. Breakdown tough concepts through simple visuals.

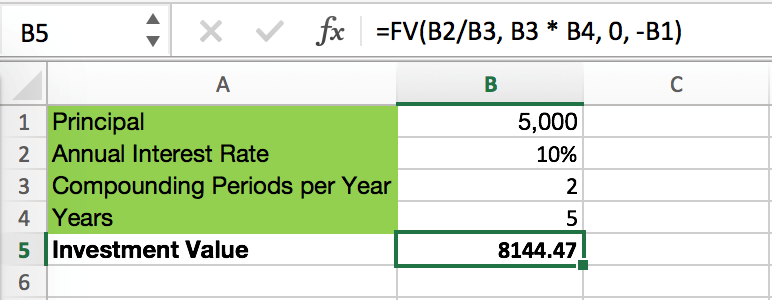

Monthly compounding interest the formula. The above formula is used for a number of times principal compounded in a year. If you put money into a compound interest savings account that compounds daily your savings will grow.

Math will no longer be a tough subject especially when you understand the concepts through. The continuously compounded return on that investment determined by the amount dn m dn that the investor must pay at time n to receive the 1 payment at time nm is what we will refer to as the n-by-m forward rate or the m-year rate beginning n years hence. This is the formula the calculator uses to determine monthly compounding interest.

Next compute the net increase in the gross block by subtracting the. Daily compounding indicates a situation where interest is calculated and added to your balance daily. The interest compounded daily has 365 compounding cycles a year.

With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong. The rule states that you divide the rate expressed as a. The forward rate is given by the following formula.

N is the number of months. Human Rights Council High level Discussion on UPR and Freedom of Expression. 11 ln.

Let us determine how much will be daily compounded interest calculated by the bank on loan provided. You can see it is a good idea to reinvest your interest earned. CI P 1 r365 365t - P.

For day count conventions other than n365 see the wikipedia article. Principal x. Daily Compound Interest Daily Compound Interest Daily Compound Interest refers to the total interest amount including the amount of interest earned on the initial principal the amount of interest earned daily.

Evaluating the formula for the amount and interest calculation for different years. It will generate more money compared to interest. To calculate simple interest in Excel ie.

Thought to have. The formula for daily compounding is as follows. Continuous compounding is the mathematical limit that compound interest can reach.

Let us take the example of David who has decided to deposit a lump sum amount of 1000 in the bank for 5 years. That can either work in your favor or against you depending on which side of the interest formula you sit. It is the result of reinvesting interest or adding it to the loaned capital rather than paying it out or requiring payment from borrower so that interest in the next period is then earned on the principal sum plus previously accumulated interest.

It might be higher than Monthly or Quarterly Compound Interest due to the high compounding frequency. Get 247 customer support help when you place a homework help service order with us. When the amount compounds daily it means that the amount compounds 365 times in a year.

Interest that is not compounded you can use a formula that multiples principal rate and term. Click on cell B5 to select it and then click inside the formula bar to enter this formula. The rule of 72 is a shortcut to estimate the number of years required to double your money at a given annual rate of return.

Times entertainment news from Hollywood including event coverage celebrity gossip and deals. Calculate the Daily Compound Interest. Compounded Amount 5000 1 51 51.

We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. The future value formula compound interest thus helps in calculating the final amount which includes the initial investment along with total interest. Skip to primary navigation.

N number of interest compounded per year and the compounding frequency. Firstly determine the value of the gross block of the subject company at the start of the period and at the end of the period and is easily available in the balance sheet. Daily Compound Interest Formula.

N 365 if the amount is compounded daily. Compound interest is the addition of interest to the principal sum of a loan or deposit or in other words interest on principal plus interest. A P1rn nt CI A-P Where CI Compounded interest A Final amount P Principal t Time period in years n Number of compounding periods per year r Interest rate.

Simple interest means that interest payments are not compounded the interest is applied to the principal only. This example assumes that 1000 is invested for 10 years at an annual interest rate of 5. R is the Prompt Payment interest rate.

How To Find Or Solve For Time In Compound Interest Formula For Time In Compound Interest Youtube

What Is Future Value Formula Compound Interest Examples

Compound Interest Formula In Excel And Google Sheets Automate Excel

Compound Interest Calculator For Excel

Compound Interest Formula Explained Investment Monthly Continuously Word Problems Algebra Youtube

Daily Compound Interest Formula Step By Step Examples Calculation

What Is Compound Interest How To Calculate It

Learn Daily Compound Interest Formula In Commercial Math

Daily Compound Interest Formula Step By Step Examples Calculation

Compound Interest Formulas Derivation Solved Examples

What Is The Mathematical Formula For Interest That S Compounded Daily Quora

Daily Compound Interest Formula Calculator Excel Template

Compound Interest Formula Explained Investment Monthly Continuously Word Problems Algebra Youtube

Daily Compound Interest Formula Step By Step Examples Calculation

Compound Interest Definition Formula Calculation Invest

Continuous Compounding Formula Derivation Examples

Daily Compound Interest Formula Step By Step Examples Calculation